Transcripts of your federal income tax return, tax account, wages and income, and record of account, as well as a verification of non-filing, are once again available for no charge online at the IRS website. Sign up to view, print, or download your transcript, or request that a transcript be mailed to you. Remember, transcripts only provide line-by-line information. If you need a copy of your original return, use Form 4506, Request for Copy of Tax Return, instead. Contact us at either 201-947-8081 or 646-688-2807 if you have questions.

Transcripts of your federal income tax return, tax account, wages and income, and record of account, as well as a verification of non-filing, are once again available for no charge online at the IRS website. Sign up to view, print, or download your transcript, or request that a transcript be mailed to you. Remember, transcripts only provide line-by-line information. If you need a copy of your original return, use Form 4506, Request for Copy of Tax Return, instead. Contact us at either 201-947-8081 or 646-688-2807 if you have questions.

Access tax details online

You can still benefit from the Work Opportunity Tax Credit

The Work Opportunity Tax Credit (WOTC) is a federal income tax break that can reduce your business income tax when you hire workers from specified groups that typically experience high unemployment rates. Normally, you have 28 days after the worker’s first day to complete the necessary paperwork for the credit. But for certain workers hired between January 1, 2015, and August 31, 2016, the 28-day rule has been extended until September 28, 2016. The extended date gives you an opportunity to review last year’s personnel files for credit-eligible employees. Contact us at either 201-947-8081 or 646-688-2807 to learn how the WOTC can help save tax dollars.

The Work Opportunity Tax Credit (WOTC) is a federal income tax break that can reduce your business income tax when you hire workers from specified groups that typically experience high unemployment rates. Normally, you have 28 days after the worker’s first day to complete the necessary paperwork for the credit. But for certain workers hired between January 1, 2015, and August 31, 2016, the 28-day rule has been extended until September 28, 2016. The extended date gives you an opportunity to review last year’s personnel files for credit-eligible employees. Contact us at either 201-947-8081 or 646-688-2807 to learn how the WOTC can help save tax dollars.

Count employees to avoid ACA penalties

![]() The IRS recently updated a web page explaining how to figure out if you’re an “applicable large employer,” or ALE. If you are, you may have to pay a penalty for not providing health insurance to your employees. For 2016, your business will generally meet the definition of an ALE if you employed an average of at least 50 full-time employees (including full-time equivalent employees) during 2015. A full-time employee for any calendar month is one who averages at least 30 hours of service per week or at least 130 hours of service during the month. Please call us at either 201-947-8081 or 646-688-2807.

The IRS recently updated a web page explaining how to figure out if you’re an “applicable large employer,” or ALE. If you are, you may have to pay a penalty for not providing health insurance to your employees. For 2016, your business will generally meet the definition of an ALE if you employed an average of at least 50 full-time employees (including full-time equivalent employees) during 2015. A full-time employee for any calendar month is one who averages at least 30 hours of service per week or at least 130 hours of service during the month. Please call us at either 201-947-8081 or 646-688-2807.

The IRS wants your RSVP for this notice

Did you receive advance payments of the federal income tax credit that helps pay your health insurance premium? You’re required to reconcile that amount with how much you’re eligible to claim and file a form with your tax return. If you forgot, the IRS will be sending you a notice – and they want a response. Failure to reply could limit your future advance payments. Contact us at either 201-947-8081 or 646-688-2807 for help.

Did you receive advance payments of the federal income tax credit that helps pay your health insurance premium? You’re required to reconcile that amount with how much you’re eligible to claim and file a form with your tax return. If you forgot, the IRS will be sending you a notice – and they want a response. Failure to reply could limit your future advance payments. Contact us at either 201-947-8081 or 646-688-2807 for help.

IRS interest rates rise for the second quarter of 2016

The interest rates the IRS charges on underpaid taxes and pays on tax overpayments have gone up for the second quarter of 2016 (April 1 through June 30). Here are the new rates for individuals and corporations.

The interest rates the IRS charges on underpaid taxes and pays on tax overpayments have gone up for the second quarter of 2016 (April 1 through June 30). Here are the new rates for individuals and corporations.

For individuals:

4% charged on underpayments; 4% paid on overpayments.

For corporations:

4% charged on underpayments; 3% paid on overpayments.

6% charged on large corporate underpayments.

1.5% paid on the portion of a corporate overpayment exceeding $10,000.

Please call us at either 201-947-8081 or 646-688-2807 for more information on this matter.

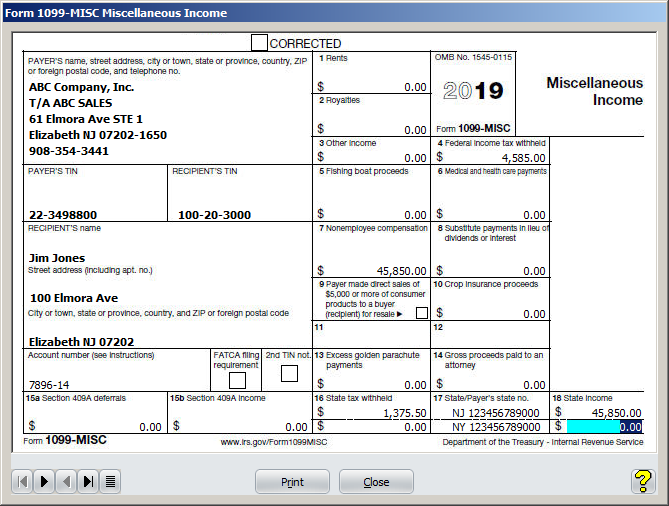

Form 1099 penalties increase sharply

Have you filed required Forms 1099 for 2015? The forms were due by February 1 to individuals you paid $600 or more in the course of your business during the year. If you haven’t completed Forms 1099, you’ll want to do so as soon as possible. The penalties for failing to file range from $50 to $250 per form, depending on how late your filing is and whether or not the failure to file was intentional. Total penalties can go as high as $1 million for businesses with gross receipts under $5 million or $3 million for those with gross receipts over $5 million. Contact us for help in determining whether you need to file.

Have you filed required Forms 1099 for 2015? The forms were due by February 1 to individuals you paid $600 or more in the course of your business during the year. If you haven’t completed Forms 1099, you’ll want to do so as soon as possible. The penalties for failing to file range from $50 to $250 per form, depending on how late your filing is and whether or not the failure to file was intentional. Total penalties can go as high as $1 million for businesses with gross receipts under $5 million or $3 million for those with gross receipts over $5 million. Contact us for help in determining whether you need to file.

Please call either 201-947-8081 or 646-688-2807 for more information on this matter.

IRS Now Required to Use Collection Agencies

IRS Now Required to Use Collection Agencies In a 1,300 page Transportation Bill signed into law in December, 2015, there are eight pages that require the IRS to assign unpaid tax bills to outside collection agencies. This means that third party companies will now be calling taxpayers as representatives of the IRS to collect unpaid taxes.

IRS Now Required to Use Collection Agencies In a 1,300 page Transportation Bill signed into law in December, 2015, there are eight pages that require the IRS to assign unpaid tax bills to outside collection agencies. This means that third party companies will now be calling taxpayers as representatives of the IRS to collect unpaid taxes.

What you need to know

What has changed. Prior to this bill, the IRS had the option, but not the “requirement”, to use other companies to try to collect past due tax bills. The IRS is now required to assign some of these unpaid taxes to outside companies for collection whether it is cost effective or not.

Non-IRS companies may call you. If the IRS thinks you owe money and the statute of limitations for collection is approaching, you may have your tax bill assigned to a debt collector. This means you could receive phone calls and communication from a third party company that has your tax information.

Your fraud alert senses should go up. This debt collector requirement may open the door to more tax fraud as thieves know they can falsely represent themselves as an agent of the IRS. Please be vigilant to this risk.

There are rules. While the IRS may assign any unpaid debt to collection agencies, the “required transfer” of unpaid debts has specific rules. You may NOT be asked to pay tax bills from a third party debt collector if:

- You are under age 18

- The taxpayer is deceased

- You are a victim of identity theft

- You have an innocent spouse case

- Your tax case is active within the IRS

Remember to be cautious if you are contacted by someone representing themselves as an agent of the IRS. At Lefstein-Suchoff CPA & Associates, LLC we have the skill, experience and knowledge to help you with your IRS debt, so don’t wait call today at 844-4TAXIRS (844-482-9477)

IRS gives worker classification criteria

Since independent contractor payments are not subject to payroll taxes, there is a temptation to classify some employees as independent contractors when they should not be. The IRS uses certain criteria to help determine who should be classified as an employee subject to payroll taxes and eligible for employee benefits. Here’s a partial list –

* Who controls when, where, and how the work is to be done?

* Who sets the working schedule?

* Is the payment by the hour or by the job?

* Whose tools will be used to accomplish the work?

* Does the contractor provide services to the general public?

Please call our office at 201-947-8081 or 646-688-2807 for more info.

IRS publishes tips for amending returns

If you discover an omission or error made on your already filed tax return, you may need to file an amended return. Here are some IRS tips for amending returns.

If you discover an omission or error made on your already filed tax return, you may need to file an amended return. Here are some IRS tips for amending returns.

1. Use Form 1040X. You must file a paper amended return; this form can’t be e-filed.

2. File an amended return to correct errors or change your original filing.

3. Don’t file an amended return to correct math errors or to attach forms you forgot to attach originally. The IRS will mail a request for the forms and will automatically correct math errors.

4. You generally have three years from the original filing date to file an amended return.

5. If you’re filing for multiple years, you must file a separate Form 1040X for each year.

6. If you’re due a refund from your original filing, wait until you’ve received the original refund before you file Form 1040X for an additional refund.

7. If you owe more tax with Form 1040X, pay it as soon as possible to avoid added interest and penalties.

8. You can track the status of your filed Form 1040X with the IRS’s “Where’s My Amended Return?” tool at www.irs.gov

Don’t let the IRS become your pen pal

Getting a letter or notice from the IRS can be upsetting, confusing, and unnecessary. The IRS sends taxpayers notices to request payment for taxes, to notify them of a change to their account, or to request additional information. Attention to the following details will reduce the likelihood that you will become pen pals with the IRS.

Getting a letter or notice from the IRS can be upsetting, confusing, and unnecessary. The IRS sends taxpayers notices to request payment for taxes, to notify them of a change to their account, or to request additional information. Attention to the following details will reduce the likelihood that you will become pen pals with the IRS.

Never send a payment to the IRS without designating what it is for. Otherwise the IRS may apply it in any manner they want. Every payment should include your name, your taxpayer identification number (social security number), the type of tax you are paying, and the period the tax payment is for.

Make sure the name and social security number on your tax return agree with the Social Security Administration’s records. If you change your surname, notify the Social Security Administration and request a new social security card.

Don’t claim a tax exemption for your child unless you are entitled to do so. Special rules apply to divorced parents. If both parents claim the child as a dependent, both returns will be subject to further IRS review.

Respond promptly to any notice you receive from the IRS, even if you think the notice is incorrect. If the IRS doesn’t hear from you within the time specified on their notice, you may lose the right to protest any changes made to your return.

Send a change of address form (Form 8822) to the IRS when your address changes. If you fail to provide the IRS with your current mailing address, you may not receive a refund check or a notice if there are problems or adjustments to your return. And even if the IRS can’t find you, penalties and interest will continue to accumulate on any tax due.

Send your income tax return and any other correspondence to the IRS by certified mail, return receipt requested. The receipt provides evidence that you filed on time. That proof will be valuable in the event the IRS or Postal Service loses your paperwork and the IRS threatens to assess late-filing and late-payment penalties.